Chained CPI and Your Taxes

Tax legislation signed at the end of 2017 made dramatic changes to the U.S. tax code for corporations and individuals. One of the most fundamental changes — a new way of measuring inflation — received relatively little attention but could have a significant effect on your taxes over the long term.

A number of key tax provisions are indexed for inflation. These include the income thresholds for tax brackets, standard deduction amounts, retirement plan contribution limits, and many more. Since the 1980s, the measure used to make adjustments has been the Consumer Price Index for all Urban Consumers (CPI-U). Beginning in 2018, the measure will be the Chained Consumer Price Index for All Urban Consumers (C-CPI-U).

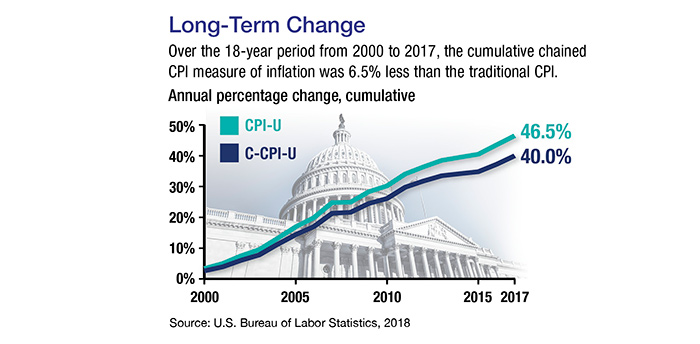

Both indexes measure changes in the price of a market basket of goods and services. However, they differ in the way they capture consumer behavior in response to changing prices. For example, if beef becomes too expensive, consumers may purchase more chicken, making chicken a more important category in the market basket for the average consumer. While the standard CPI is only adjusted every two years for this type of shift in category weighting, the chained CPI is adjusted monthly. This results in a lower inflation measure (see chart).

Although the difference for your taxes in any given year may not be noticeable, over time this small difference can add up as a larger percentage of income is pushed into higher tax brackets. One analysis estimated that, due to the new measure, after-tax income will drop about 0.2% to 0.3% by 2027 for people earning between $40,000 and $1 million annually. The difference could become larger in later years as the lower annual inflation measure accumulates.1

Many economists believe the chained CPI is a more accurate measure of inflation, and the idea of moving to chained CPI has received bipartisan support over the years.2 However, the new inflation measure is a permanent change to help pay for permanent corporate tax cuts, whereas most individual tax cuts are scheduled to expire after 2025. It remains to be seen how this will play out for individual taxpayers.