Income for the Long Run

In a recent survey of 3,000 Americans ranging in age from 20 to 70, almost two-thirds of the respondents said they feared running out of money in retirement more than they feared death.1 Fear may not be a helpful response, but this concern is not surprising considering changes in the American retirement landscape.

People are living longer during a time when traditional pensions are disappearing and medical expenses continue to climb. Social Security may provide a dependable, supplemental income throughout retirement, but benefit levels are not high enough to fund a comfortable retirement for most people. In January 2018, the average monthly benefit was just $1,404, and the maximum benefit at full retirement age was $2,788.2

Even people with a substantial nest egg face a challenge in making their savings last throughout a long retirement. Withdrawing too much too quickly can put you at risk of running out of money, while being overly cautious and withdrawing too little might lead to a less satisfying retirement lifestyle than you might otherwise enjoy.

Late-Life Financial Stability

One way to help solidify your retirement income picture and provide a steady income late in life is by purchasing a longevity annuity, a deferred fixed annuity that delays lifelong income payments until a future date — often when the contract owner reaches age 80 or 85. Because the annuity income is deferred, the payouts are typically higher in relation to the premiums than they would be if the annuity income had been paid immediately. Purchasing the annuity at a younger age with a longer deferral period would generally give you a better premium-to-income ratio.

A longevity annuity may give you more confidence that you will have income for a long life, while also making it easier to manage the near-term income from your savings and investments. For example, if you retire at age 65 and feel comfortable that the combined income from your annuity and Social Security will meet your income needs after you reach age 85, you could focus on funding your earlier retirement years from other savings and investments for a 20-year period, rather than guessing how long your savings might have to last.

The QLAC Opportunity

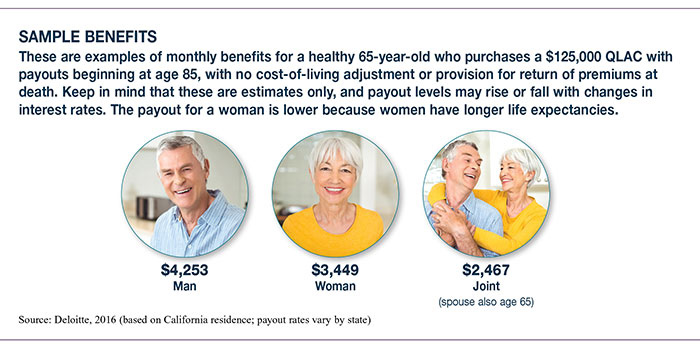

Longevity annuities are not new, but a relatively recent option allows you to purchase a qualified longevity annuity contract (QLAC) in a qualified retirement account such as a 401(k) or an IRA. This enables you to use some of your retirement savings — a maximum $125,000 or 25% of the account value, whichever is lower — to purchase the annuity, with the funds excluded from your required minimum distributions when you turn age 70½. Income payments must begin no later than the first day of the month following your 85th birthday.

As with nonqualified annuities, QLAC rules allow for certain extra features, including (1) the continuation of income payments throughout the lifetime of a beneficiary, such as a surviving spouse; (2) the return of premiums (minus payouts) as a death benefit; and (3) cost-of-living adjustments to help address the effect of inflation on the future purchasing power of annuity payouts. However, these options will either raise the purchase price or reduce income payments. Without the optional death benefit, insurers will generally keep the premiums paid if the annuity owner dies, even if payouts have not yet begun and the contract is terminated.

Cash-out provisions are not allowed in QLACs, so any money invested in the annuity is no longer a liquid asset, and you may sacrifice the opportunity for higher investment returns that might be available in the financial markets. (By contrast, nonqualified annuities may offer a cash-out option that permits withdrawals during the deferral phase, but surrender charges typically would apply.) Like other distributions from tax-deferred retirement plans, income payments from QLACs are fully taxable. (With nonqualified annuities purchased outside a retirement plan, only the earnings portion is taxed.)

Like most annuities, a QLAC typically is purchased with a lump sum. If your employer offers a QLAC option in your retirement plan, you may be able to invest through regular salary deferrals.

Annuities are insurance-based contracts that have exclusions, contract limitations, fees, expenses, termination provisions, and terms for keeping them in force. Any guarantees are contingent on the financial strength and claims-paying ability of the issuing insurance company.