Making Sense of Bond Behavior

Federal Reserve monetary policies can affect the financial markets, and the prospect of higher inflation and interest rates has become a major concern for bond investors. Even so, many investors rely on bonds to temper the effects of stock market volatility on their portfolios or to generate income in retirement.

Here are some strategies that may help your fixed-income portfolio weather a period of interest rate uncertainty.

Keep It Short and Hold On

When interest rates rise, the value of existing bonds typically falls, because new bonds with higher yields are more attractive. Investors are also less willing to tie up their funds for a long time, so bonds with longer maturity dates are generally more sensitive to rate changes than shorter-dated bonds. Thus, one way to help address interest rate risk is to focus on short- and medium-term bonds, even though they will generally offer lower yields.

When a bond is held to maturity, the bond owner receives the face value and interest, unless the issuer defaults. However, bonds redeemed prior to maturity may be worth more or less than their original value. Thus, rising interest rates should not affect the return on a bond you hold to maturity but may affect the price of a bond you want to sell on the secondary market.

Consider Duration

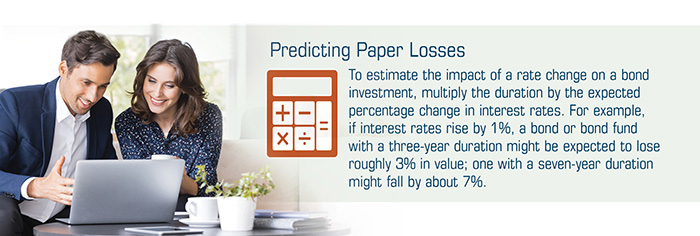

Duration is a more specific measure of interest rate sensitivity. A bond’s duration is derived from a complex calculation that includes the maturity date, the present value of principal and interest to be received in the future, and other factors.

If there are two bonds with a particular maturity, the bond with the higher yield will typically have a shorter duration. For example, U.S. Treasuries generally have lower yields than similarly dated corporate bonds, which means Treasuries also have longer durations and tend to be more rate sensitive.

What About Funds?

Bond funds — mutual funds and exchange-traded funds (ETFs) composed mostly of bonds and other debt instruments — are subject to the same inflation, interest rate, and credit risks associated with their underlying bonds. Consequently, the share prices of funds that hold short- or medium-term bonds may be more stable than those holding longer-term bonds. Bond funds do not typically have set maturity dates, but you can look at the fund’s duration.

Keep in mind that fund managers might respond differently if falling bond prices adversely affect a fund’s performance. Some might try to preserve the fund’s asset value by reducing its yield. Others might preserve a fund’s yield at the expense of its asset value by investing in riskier bonds of longer duration or lower credit quality. Information on a fund’s management, objectives, and flexibility in meeting those objectives is spelled out in the prospectus.

Beyond interest rates, fund returns can be driven by a variety of dynamics in the market and the broader economy. In a rising rate environment, as underlying bonds mature and are replaced by higher-yielding bonds, the fund’s yield and/or share value could potentially increase over time. For investors with longer time horizons, reinvesting the interest paid by the fund could also help offset any losses in share value.

The return and principal value of bond funds and ETFs fluctuate with market conditions. Shares, when sold, may be worth more or less than their original cost. Supply and demand for ETF shares may cause them to trade at a premium or a discount relative to the value of the underlying shares.

Mutual funds and ETFs are sold by prospectus. Please consider the investment objectives, risks, charges, and expenses carefully before investing. The prospectus, which contains this and other information about the investment company, can be obtained from your financial professional. Be sure to read the prospectus carefully before deciding whether to invest.